All Categories

Featured

Table of Contents

- – The Role Of Stablecoins In The Crypto Market

- – Top Cryptocurrency Wallets For Maximum Security

- – Best Crypto Exchanges For High Liquidity

- – Best Practices For Crypto Security In 2024

- – How To Choose The Right Crypto Exchange

- – A Guide To Cryptocurrency Taxes In 2024

- – Best Defi Platforms For Earning Passive Income

They recognize the volatility of the crypto market and are prepared to weather the tornado, so to talk. Hodlers accept the inevitable downward and higher swings, and they react less emotionally to birth market and advancing market scenarios. As a result of their lasting financial investment method, they are awaiting an excellent minute to squander.

They're preparing for a future in which bitcoin and others cryptocurrencies would be approved as worldwide currencies; maybe even change fiat cash. Will there be a standard shift in how society views the financial system and Bitcoin?

The Role Of Stablecoins In The Crypto Market

They usually have one of the most experience, are well-informed, and they very closely follow every nuance of the market. Investors make comprehensive prediction versions based upon mathematical principles. They are planned for the tiniest of cost modifications, which is why they are not terrified of taking big risks. Some investors are in it for the long-term while others desire to invest for the temporary and cash money out as promptly as feasible.

Yet also professional investors can't forecast the future. What they do have is the understanding to optimize their possibilities of success in this market. They purchased bitcoin before it was great, and they acknowledged its potential when others believed it was simply a rip-off or a device for unlawful on-line transactions.

Top Cryptocurrency Wallets For Maximum Security

This can occur simply by good luck, yet they are normally interested in technology. Early crypto adopters are usually anonymous since it would not be the finest concept to allow every person recognize that they rest on millions in bitcoin or that they have currently paid out millions.

It is likewise possible for a single person to be a component of multiple classifications. Financiers are often also "hodlers" and vice-versa. If you are simply beginning with purchasing cryptocurrencies, my recommendation would certainly be to check out the modern technology as long as you can. Be honest with on your own and try to make a sincere assessment of your strategies.

Hodlers; since they get a cost-free electronic purse, with 98% of funds stored in a protected offline freezer. They can additionally purchase cryptocurrencies directly with euro and send out the coins to their private wallet for lasting storage space. In that sense, Kriptomat can be viewed as a fiat gateway and individual crypto checking account.

NOTEThis text is useful in nature and ought to not be thought about a financial investment recommendation. It does not express the personal point of view of the writer or solution. Any type of investment or trading is risky, and previous returns are not a warranty of future returns. Danger only assets that you agree to lose.

Best Crypto Exchanges For High Liquidity

Are you crypto curious? Are you curious about cryptocurrency investing, yet do not desire to have Bitcoin or any type of other token? Cryptocurrency stocks are shares in publicly traded funds or business that have substantial exposure to cryptocurrency or an additional application of blockchain technology.

Miners require hardwaresometimes great deals of hardware!to finish the job. If you assume these demands will certainly remain to grow, you may consider purchasing business that make specialized equipment for crypto miners. (NVDA) and (AMD) are 2 of the best-known competitors in this room. Some publicly traded companies in a selection of sectorsrelated and in some cases unassociated to cryptocurrencyown significant portfolios of cryptocurrency on their corporate balance sheets.

Best Practices For Crypto Security In 2024

Share rates of companies with large cryptocurrency holdings are most likely to correlate with cryptocurrency rates than those of firms that do not hold any type of crypto. Below are some publicly traded companies that own considerable cryptocurrency possessions: Formerly known as "Square," Block is an economic modern technology business that enables entrepreneur and consumers to send and receive settlements.

Details business and funds are mentioned in this post for educational objectives only and not as an endorsement.

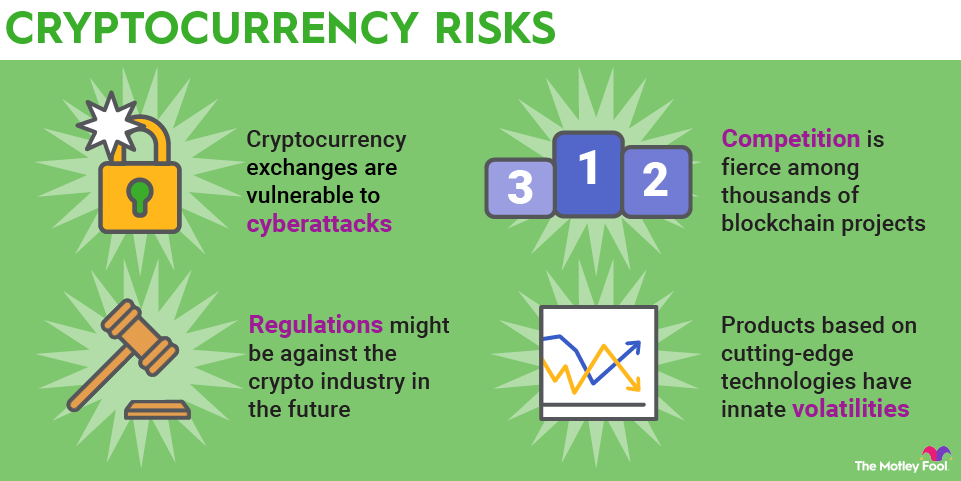

Digital money like cryptocurrencies proceed to be worthwhile investments for many investors."Nonetheless, cryptocurrency is an immensely high-risk and unstable financial investment inappropriate for newbies or conventional financiers.

"From a financial investment perspective, crypto is rapidly progressing," says Donna Parisi, worldwide head of financial services and FinTech at Shearman & Sterling. "You shouldn't place in a quantity of assets you're not going to lose. It must be, fairly talking, a small section of your portfolio." Cryptocurrencies are decentralized, suggesting they aren't controlled by any type of single person, business, or federal government - Decentralized Apps.

How To Choose The Right Crypto Exchange

Copies of the blockchain are kept and preserved by computers worldwide. They're commonly contrasted to basic journals, which are component of conventional double-entry accounting systems where each transaction leads to debit and credit history in various sections of guides. "It works like a general journal it's that basic," says David Donovan, executive vice head of state at Publicis Sapient.

"On the blockchain, it would certainly say I'm sending you one coin, and I now have one coin, and you have one coin." Each grouping of purchases is become a block and chained to the existing ledger. As soon as a block is added, it can't be reversed or altered which is why people define blockchains as "immutable." The blockchain modern technology behind cryptocurrencies guarantees that the coins and systems continue to be safe.

A Guide To Cryptocurrency Taxes In 2024

The absence of regulative oversight and basic consumer security leaves crypto investors vulnerable to exploitation. Cryptocurrencies' decentralized nature makes recovering funds or tracking down scammers hard.

A public trick is obtained from the exclusive trick and serves as the address to send crypto to the purse. Cryptocurrencies are more susceptible to frauds and hacks, there are security procedures you can establish up to additional protect your investments.

Best Defi Platforms For Earning Passive Income

As a personal finance specialist in her 20s, Tessa is really familiar with the effects time and unpredictability have on your financial investment choices. While she curates Service Insider's overview on the very best investment applications, she believes that your monetary portfolio does not need to be excellent, it simply needs to exist.

Crypto funds are typically long-lasting financiers that supply resources to startups in exchange for equity in the firm or tokens. They often work as equity capital funds. Crypto funds gather capital from both personal and institutional capitalists to invest in crypto projects and associated assets. These funds are supervised by professional supervisors that study the marketplace, track fads, and make informed decisions on purchasing or selling possessions within the fund's portfolio.

Table of Contents

- – The Role Of Stablecoins In The Crypto Market

- – Top Cryptocurrency Wallets For Maximum Security

- – Best Crypto Exchanges For High Liquidity

- – Best Practices For Crypto Security In 2024

- – How To Choose The Right Crypto Exchange

- – A Guide To Cryptocurrency Taxes In 2024

- – Best Defi Platforms For Earning Passive Income

Latest Posts

Best Strategies For Investing In Crypto In 2024

Cryptocurrency Staking: A Guide To Earning Passive Income

Best Practices For Crypto Security In 2024

More

Latest Posts

Best Strategies For Investing In Crypto In 2024

Cryptocurrency Staking: A Guide To Earning Passive Income

Best Practices For Crypto Security In 2024